According to IFRS IAS 33, companies whose ordinary shares are traded on the open market (exchange or over-the-counter) are required to disclose information on earnings per share, i.e. calculate and show in the reporting the so-called EPS indicator (earnings per share). There are two indicators: 1) basic earnings per share (basic EPS) and 2) diluted earnings per share (diluted EPS). This article is devoted to the consideration of basic earnings per share - the formula, calculation technique and examples of solving problems from the ACCA exams (both Dipifre and F7 papers). described in the next article.

Basic Earnings Per Share Formula

Basic EPS shows how much net income for the period is accounted for by one ordinary share in circulation. This is a relative indicator of profitability, which, in contrast to the absolute value of net profit, is considered a more reliable indicator of the company's success. IAS 33 Earnings per Share was introduced to unify the practice of calculating EPS.

At its simplest, the EPS formula looks like this:

EPS = Net income for the period / Number of ordinary shares, where

- in the numerator of the formula— net (after-tax) profit to which holders of ordinary shares are entitled

- in the denominator of the formula— the weighted average number of ordinary shares for reporting period(year).

For Russia, where the capital structure of most companies is quite simple and consists only of ordinary shares, the calculation of earnings per share does not cause much difficulty. However, in Western practice, where there are different types of preferred shares and where the issuance and redemption of common shares is common practice, calculating the underlying EPS is a more complex exercise.

What profit should be taken to calculate the base EPS? Formula numerator.

First, it is the net (=after-tax) profit, and secondly, it is the profit attributable to ordinary shareholders.

To find the amount of profit for calculating the basic EPS, dividends on preferred shares must be excluded from the net income. In general, preferred shares are financial instruments that do not have voting rights, but have certain privileges: a) dividends on them are a fixed amount, and not a share in profits like ordinary shareholders; b) in the event of bankruptcy, the owners of such shares have an advantage over ordinary shareholders in recovering losses. Essentially, a preferred share is a cross between a common stock and a bond.

I don’t know if this will happen on the exam, but in Western practice there are two types of preferred shares:

- cumulative preference shares (on which unpaid dividends are accumulated and paid out subsequently)

- non-cumulative preferred shares (dividends are lost, do not accumulate in case of non-payment)

In the first case, dividends must be paid anyway, so they are deducted from earnings for calculating EPS, whether declared or not. For non-cumulative preference shares, dividends only reduce earnings in the numerator of the EPS formula if they have been declared.

Calculation of the weighted average number of shares - emission factor. Formula denominator.

The hardest part of EPS problems is finding the denominator in the EPS formula. The weighted average number of shares for the period may increase during the period as a result of the issue (issue) of new ordinary shares. Repurchase of shares from the market, on the contrary, leads to a decrease in this value.

Consider the following options for issuing shares:

- issue at market price — simple;

- issue without reimbursement of their value - preferential*;

- issue with partial reimbursement of their cost – release of rights.

In all three cases, there will be a fall in earnings per share at the time of issuance, because the denominator of the formula will increase.

In this article, I use the method of calculating the weighted average number of shares through emission factors for all three options. Outwardly, this method seems different from the one that is written in the standard and is in the textbooks. However, mathematically, this is exactly the same calculation method that gives the correct result.

1. Simple issue of shares at market value

With this issue, there are more shares in circulation for the market price. Here is an example from IAS 33, which is repeated in all textbooks:

- On January 1, there were 1,700 shares of common stock outstanding,

- On May 31, 800 shares were placed at market value, and

- On December 1, 250 shares were bought back at full price.

A graphical representation of the condition of the example will help:

IAS 33 provides two methods of calculation, but I suggest using one, in my opinion, simpler:

1,700 x 5/12 + 2,500 x 6/12 + 2,250 x 1/12 = 2, 146 pieces.

As you can see from the formula, the number of shares must be multiplied by the number of months until the next event (issue or buyback) divided by 12. That is, the number of shares is weighted in proportion to the period during which it did not change.

2. Issue of rights (rights issue)

This issue gives the right to shareholders to purchase new shares at a price below the market price - something between a preferential (free) issue and an issue at a market price. Because although the company receives a refund for the issued shares, this compensation will be less than if the shares were issued on market terms.

Example 4 from IAS 33.

As of January 1, there were 500 ordinary shares in circulation. On January 1, the company announced a preferential issue of 1 to 5 at a price of $5 per new share. March 1 is the last day to buy the rights at the offered price. The market price of one common share before March 1 (the close of the buyback period) was $11. How to calculate the weighted average number of shares per year?

First, on March 1, 100 (500/5) new ordinary shares will be added, so 500 shares will be multiplied by 2/12, and 600 shares by 10/12.

Secondly, since this is an issue of rights and the placement price is lower than the market price, the standard prescribes the use of an emission factor (EF). And the formula for calculating the weighted average number of shares will be:

500 x 2/12 x KE + 600 x 10/12 = X

*CE is not a common abbreviation

The issue ratio is calculated as the ratio of the market price of a share to the theoretical price after the rights are issued. In this example, the market price is $11, and the post-issue price (in red) is calculated as follows:

| the date | Stock | Proportion | Price, $ |

Price |

| (a) | (b) | (in) | (d) = (a) x (c) | |

| 1st of January | 500 | 5 | 11 | 5,500 |

| March 1 | 100 | 1 | 5 | 500 |

| Total | 600 | 6 | 6,000/600=10 | 6,000 |

The calculation algorithm is as follows:

- value of outstanding shares before rights issue: 500 x 11 = 5,500

- rights issue cost: 100 x 5 = 500

- Total value of all shares (old and new): 5,500 + 500 = 6,000

Theoretical price after rights issue: 6,000/600 = $10.

This emission factor (CE): 11/10

The weighted average number of shares per year will be: 500 x 2/12 x 11/10 + 600 x 10/12 = 591.67 shares.

If instead of the number of shares we use a ratio of 5 to 1, then the result will be similar, the theoretical price after the rights issue will be equal to $10:

a) 5 x 11 = 55, b) 1 x 5 = 5, c) 55+5 = 60, d) 60/6 = 10

Now let's change the condition a little and imagine that March 1 was simple issuance at a market price of $11, not a rights issue at $5. If we make exactly the same table, but put the figure $11 everywhere in the “price” column, then it is easy to see that the theoretical price after such an issue will be equal to $11, i.e. market price. That is, we have obtained that the simple emission coefficient is equal to one (11/11 = 1).

3. Free issue of shares (bonus issue)

O terminology. I wanted to call this type of issue preferential, however, in the standard, any issue is called preferential issue if the issue of shares is less than the market price (that is, the issue of rights is also a preferential issue). Therefore, I decided to use the words “bonus” or “free” issue. But I want to warn you that these are not generally accepted terms, I use these words only for ease of explanation.

Sometimes companies issue ordinary shares to existing shareholders without reimbursing their value. As they said in one of our famous Soviet cartoons: "free of charge, that is, for nothing." How will such an issue affect the calculation of the weighted average number of shares for EPS?

Let's change the previous example 4 again.

As of January 1, there were 500 ordinary shares in circulation. And on March 1, the company held a preferential issue in the ratio of 1 new share for every 5 ordinary shares in circulation. The market price of one common share before March 1 was $11.

The time scale will not change, but the table will be slightly different:

| the date | Stock | Proportion | Price, $ |

Price |

| (a) | (b) | (in) | (d) = (a) x (c) | |

| 1st of January | 500 | 5 | 11 | 5,500 |

| March 1 | 100 | 1 | 0 | 0 |

| Total | 600 | 5,500/600=9,17 | 5,500 |

Theoretical price after preferential issue: 5,500/600 = $9.1666.

This emission factor (KE): 11/9.1666 = 1.2

Weighted average number of shares per year: 500 x 1.2 x 2/12 + 600 x 10/12 = 600 shares.

If you multiply 500 by a factor of 1.2, you get 600. And the formula above can be rewritten in a different way: 600 x 2/12 + 600 x 10/12 = 600 pieces.

That is, with a free issue of shares, it turns out that the new number of shares (in this case, 600 pieces) has always been. Mathematically it is.

Two share issues in one example - how to find the weighted average number for the year?

As shown above, all three types of share issue can be accounted for using an emission factor (EF):

- emission at market price: EC = 1 (unit)

- rights issue: PE = market price before issue / theoretical price after issue

- free issue: PE = new number of shares outstanding / old number of shares

What will happen if there is more than one issue of shares during the year?

Graphically, a problem with several emissions can be represented as a time scale as follows:

For fans of long formulas: if during the year there were several issues of ordinary shares, then in general the formula for calculating the weighted average number of shares can be written as follows (not generally accepted!):

A1 x KE1 x KE2 x m1/12 + A2 x KE2 x m2/12 + A3 x m3/12, where

KE is the issue ratio, A is the number of shares in a given period of time, m is the number of months between issues, N is the number of new shares, that is, A1 + N2 = A2, A2 + N3 = A3, A3 = A4. All designations are not generally accepted and invented by me for lack of others.

An example of calculating the basic EPS with simple and privileged issues during the year

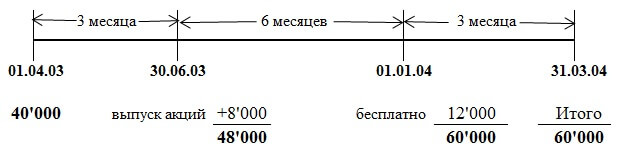

The number of ordinary shares of Savoir as of April 1, 2003 was 40 million. On July 1, 2003 Savoir issued 8 million shares of common stock at market value. On January 1, 2004, a preferential issue of one common share for every four shares outstanding was made. Profit attributable to ordinary shareholders was $13,800,000. The reporting date is March 31, 2004.

In this example, you need to take into account two issues of shares during the year: after 3 months, the issue at market value, after another 6 months - a "free" issue. Everything becomes clearer when all the numbers from the condition of the problem are plotted on the time scale:

The first issue ratio at market value is 1 (always), the free issue ratio is 60,000 / 48,000 = 1.25 (number of shares "after" / number of shares "before")

The weighted average number of shares per year will be:

40,000 x EC1 x EC2 x 3/12 + 48,000 x EC2 x 6/12 + 60,000 x 3/12 = 57,500

40,000 x 1 x 1.25 x 3/12 + 48,000 x 1.25 x 6/12 + 60,000 x 3/12 = 57.500

Earnings per share: 13,800/57,500 = $0.24 or 24 cents.

When solving this problem, I used a formula with coefficients, and in the official answer a slightly different way of calculating is given. But the answer is the same, because both ways are correct.

WARNING: Because this site is not an official tutorial, I can use any technique I see fit to explain the material. It is useful to look at the calculations from a different angle. But I am not sure that the method presented here for calculating the weighted average number of shares in the exam will be evaluated correctly. Still, the markers checking the exam studied from textbooks, in which the method of obtaining an answer (in the presence of a free issue) outwardly differs somewhat. Just keep that in mind. Although the correct result of the calculations should speak for itself.

Extract from the official response

The July 1, 2003 issue at full market value should be weighted: 40 million x 3/12 + 48 million x 9/12 = 46 million. ).

A 1 for 4 bonus issue would result in 12 million new shares, bringing the total number of ordinary shares to 60 million. The dilutive effect of the bonus issue would reduce earnings per share to 24 cents(30 cents x 48 million/60 million).

Direct and inverse emission factors

All emission factors discussed above are called direct and are used to calculate the weighted average number of shares for the period. The value of 1/EQ is the reciprocal of the emission factor, which is needed to obtain comparative data. If there was an issue of rights in the reporting period, then this will affect both the EPS value in the current IFRS financial statements and the EPS value in the previous financial statements. To obtain comparative data on EPS for the previous year, it is necessary to recalculate the EPS of the previous year, multiplying it by the inverse emission factor of the reporting year. If there were two issues and two coefficients, then both reciprocal coefficients must be used for recalculation.

Basic earnings per share - another example of calculation

Let's try to solve another problem, this time from the Dipifre exam, March 2009, question 4, 6 points.

(b) Epsilon prepares annual financial statements for the year ending 31 December. The company's net income for the year ended December 31, 2008 was $12 million. This figure was formed after subtracting financial expenses relating to preferred shares in the amount of $600,000. As of January 1, 2008 Epsilon had 30 million ordinary shares outstanding. On April 1, 2008 Epsilon issued 20 million shares of common stock at full market value. Epsilon issued share purchase rights on October 1, 2008, offering the company's existing shareholders (including holders of shares issued on April 1, 2008) to purchase 1 share for every 5 they own, at a price of $2 per share.

This issue was completely redeemed by the shareholders. The market value of one share of Epsilon common stock on October 1, 2008 immediately prior to the issue of the rights to purchase shares was $2.30. Earnings per share reported in the financial statements for the year ended 31 December 2007 was 22 cents.

Exercise: Calculate the earnings per share (including comparatives) to be reported in Epsilon's financial statements for the year ended December 31, 2008.

The solution of the problem

The numerator of the earnings per share formula is $12,000,000. The condition states that this net income figure has already been adjusted for dividends to preferred shareholders, which means that no further adjustments are required.

During the year there were two issues of shares: after 3 months from the beginning of the year, a simple issue at market value, after another six months - the issue of rights.

The emission factor at the market price is equal to 1 (one).

The emission factor for the issue of rights will be equal to 2.30/2.25:

| the date | Stock | Proportion | Price, $ |

Price |

| (a) | (b) | (in) | (d) = (a) x (c) | |

| April 1 | 50’000 | 5 | 2,30 | 115’000 |

| March 1 | 10’000 | 1 | 2 | 20’000 |

| Total | 60’000 | 2’25 | 135,000 |

The calculation of the weighted average number of shares will be as follows:

30,000 x 1 x 2.30/2.25 x 3/12 + 50,000 x 2.30/2.25 x 6/12 + 60,000 x 3/12 = 48,222 pieces.

Basic earnings per share: 12,000,000 / 48.222 = 0.249 or 24.9 cents

Comparative data for the previous year should be multiplied by the reciprocal emission factors:

22 x 1 x 2.25 / 2.3 \u003d 21.5 (for unity, the inverse coefficient is also 1)

IAS 33 Earnings per Share on the Dipifre and ACCA exams

On the Dipifre exam, this topic appeared only twice - in March 2009 by 25 points (Russian-language exam) and in December 2010 by 15 points (globally). In both cases, this was a task that included both theoretical questions and the calculation of both EPS measures - basic and diluted earnings per share. In the new format of the Dipifre exam, introduced in June 2011, this standard has never appeared. Perhaps that is why many teachers and students of Dipifr courses expect the task of calculating earnings per share in the near future.

In on this moment IAS 33 ranks second with 23%. In the same year, IAS 33 took first place in the rating of expectations with 35% of the votes.

To be honest, I am skeptical that EPS will appear on the Dipifre exam anytime soon. By and large, the calculation of earnings per share has nothing to do with accounting. IFRS 33 describes an algorithm for calculating a numerical indicator, nothing more. Our examiner, on the other hand, strives to include tasks in the exam that require the ability to reason and explain the basic principles accounting laid down in international standards.

Although, I may be wrong, and Paul Robins is just waiting for the right moment to include such a problem in the exam. If the calculation of earnings per share appears on the Dipifre exam, I think it will be a simplification of the exam from the point of view of our examiner, since calculating a few numbers is much easier than writing explanations on a theoretical question.

As for the main ACCA program, the calculation of the EPS indicator appeared several times in the tasks of the F7 paper: June 2006, December 2009, June 2011, but the calculation task was never on the higher level exam P2 (if I did not miss anything).

Mathematics is gymnastics for the mind

I hope that this article did not turn out to be too boring, although I'm not sure about it. Too many formulas, too many calculations. And yet, I think that tasks on this topic will be more like a gift from the examiner than vice versa. After all, in order to correctly calculate earnings per share, you just need to remember the calculation algorithm. And in order to write an answer to a theoretical question, you need to understand what Paul Robins wants to see in the answer.

"If math doesn't seem easy to people, it's because people don't understand how complicated life is." John von Neumann, mathematician

About the uniqueness of publications

All articles on this site are written by me from beginning to end. And there is confirmation of this. That is why, unfortunately, I rarely write new articles - it takes time, which is in short supply. I met reprints of materials from this site on other Internet resources. Some copies have a link to the original on my website. But if on other sites on the Internet there is no link to the original publication here, then you should know that this is nothing more than plagiarism. The same applies to non-Internet borrowing. But such is the fate of all those who write and publish anything on the net.

A joint-stock company may pay dividends based on the results of its activities in the operating period. This is the profit that the owners receive valuable papers in accordance with its share in the authorized capital of the enterprise. Dividends are the most important indicator of a company's performance. They are calculated from net income.

It will help to understand the established methodology. This procedure is regulated by law. The determination of the part of net profit that will be used to pay dividends takes place at the meeting of shareholders. How this process takes place should be known to every owner of securities.

The concept of dividends

Dividends are the profit that a shareholder receives when he invests in authorized capital organizations. These funds are transferred per share. Part of the net profit that the organization receives at the end of the reporting period can be used to pay dividends. The decision on the amount of payments is made at the general meeting of shareholders.

Each holder of securities can, after the amount of funds that will not be directed by the organization for self-development or investment activities, is established. The calculation is done gradually. For this purpose, accounting data, as well as the standards established by law, are applied.

In other words, a dividend is the share of net income per share. It is distributed in proportion to the number of securities, taking into account their types and categories. The amount of payments is set as a percentage of the face value or in monetary terms.

The amount of profit per share cannot be higher than the level established by the Supervisory Board. Therefore, the Board of Shareholders cannot raise the level of dividends approved by the Board of Directors.

Dividends are paid exclusively by joint-stock companies or LLC. By law, only those companies that carry out transactions with securities on stock market.

Types of dividends

Before you find out, you should familiarize yourself with the existing types of such payments. They depend on a number of characteristics of securities.

Shares are ordinary and preferred. In the first case, the securities give their holder the right to vote at the meeting of shareholders and reflect his share in the authorized capital of the organization. They give the right to receive profit and the corresponding part of the property upon liquidation of the company (after paying off the debt to creditors).

Ordinary shares are considered securities with a fairly high risk factor. If the company received an insufficient amount of net profit in the reporting period or it was decided to allocate all funds for the development of the company, the shareholder may not receive dividends in current year generally.

Calculate dividends on preferred shares it will be easier knowing the features of these securities. They do not entitle their owner to participate in voting at the general meeting. However, such shareholders are the first to receive income in the distribution of net profit. At the same time, the level of risk will be much lower than for the owner of the previous type of securities. Also, upon liquidation of the organization, the holder of preferred shares receives the priority right to receive the corresponding share of the property.

In other words, in a situation where there is a distribution of net profit, the owner of preferred shares is more likely to make a profit from his securities. The priority right is reserved for him in the distribution of liquidation payments. Since this type of security does not have a high level of risk, the payouts on it will be minimal. Owners of ordinary shares can get more income. However, the risk in this case will be much higher.

The value of shares in the stock market will be higher if the company pays dividends consistently and the amount of net profit distributed is high enough. Therefore, companies engaged in such trading are interested in paying off obligations on their securities. In this case, the value of the company itself also increases.

Dividends are also distinguished by the payment period. There are securities that are paid once a year, quarter, six months. According to the method of repayment, cash dividends and paid in the form of property are distinguished.

What stocks pay dividends?

Before, how to calculate dividends for LLC founders or JSC, you should consider which shares can be paid. They are made only for those securities that are fully paid by the participants and are in their hands.

However, some groups of securities do not accrue dividends. This is possible if the shares have not yet been placed (issued) into circulation. Also, part of the securities that were purchased by the supervisory board and are on the balance sheet of the organization does not participate in the distribution of net profit. Such shares may be withdrawn from circulation at the request of the general meeting of participants in the company. This also applies to those securities that were not paid in part or in full during the acquisition process, as well as those that entered the company's balance sheet for this reason.

In all other cases, dividends are paid in accordance with the size of the distributed net profit. Its undistributed part is directed to the modernization and development of the company. For these funds, they purchase new equipment, introduce more advanced production cycles, etc. If a decision is made at the meeting of shareholders to send all net profit for the development of the company, dividends on ordinary shares will not be paid.

The profit that remains after paying dividends is called retained earnings. It is reflected in the corresponding balance sheet item.

Legislation defines several situations when calculate the amount of dividends on shares it is forbidden. In this case, it is prohibited to announce annual payments of profit on the company's securities in circulation.

This situation may arise if the authorized capital has not been paid in full. Dividends are not paid in the event that the requirements for the amount of the value of the net assets of the organization are not met. It is prohibited to carry out such a procedure before the redemption of all shares (at the request of shareholders). The law does not allow the payment of dividends if, after this process, there are (or there is a likelihood) signs of bankruptcy.

Taxation

Before how to calculate stock dividends, one should also consider tax law regarding such payments. A joint-stock company or LLC is obliged to collect and timely transfer taxes to the budget when distributing net profit among the owners of securities. This amount is retained by the organization when making such payments.

Such transfers can be made once a quarter, year or half a year. This depends on the type of securities and the accounting procedures of the enterprise and applies only to joint-stock companies. The LLC charges tax on dividends once a year.

The taxable base is the income of a member of the company received from shares owned by him. This profit is received by shareholders from the company in the process of distribution of net profit.

Calculate tax on dividends the organization can after determining the size of its net profit based on the results of activities in the reporting period. To do this, deductions are made from the income of the company in mandatory funds and the state budget. After determining the net income at the meeting of the company's participants, a decision is made on the amount retained earnings and a dividend fund.

Also applies to the taxable base are profits received from foreign companies and recognized by the legislation of other countries as a fund for paying dividends. Therefore, statutory funds must also be transferred from such income.

Dividends also include payments to participants from retained earnings of previous years.

The nuances of determining the taxable base

Before how to calculate dividend amount There are a few other things to keep in mind regarding taxes. The liquidation payments received by him are not recognized as income of the holder of securities from whom funds are withheld in mandatory funds. However, they should not exceed the amount of the participant's contribution to the statutory fund.

Payments made by a company in the form of a transfer of ownership of shares are not taxed. Also, funds that a company consisting of contributions from a non-profit organization contributes to the statutory activities of such a non-profit organization are not recognized as dividends.

Dividends can only be recognized as payments from net profit, which are made in proportion to the share of each participant. For an LLC, a special procedure for the distribution of income may apply. It may not be proportional to the share of each participant. Such funds are taxed at the rate of income or personal income tax.

Therefore, the procedure for how to calculate dividends for founder, will be different for different organizations. If the company is in the SST payment regime, the taxable base will be calculated in the same way as for a company with general regime transfers. But if such an organization pays dividends to a legal entity, it must also calculate income tax.

If the recipient of the dividend is legal entity which pays taxes on USN system, categories such as "income", "income minus expenses" are also calculated using a single methodology. For recipients of dividends who are in the UTII payment regime, income tax on such income is not paid. Such deductions are made in a general manner.

Dividend Calculation

D = (SD - ADS) / KA, where D - dividends, SD - the total amount of regular dividends distributed among the participants, ADS - the amount of one-time (special) dividends, KA - the number of shares.

All indicators used for the calculation can be found in the regular financial statements. It is impossible to take the level of payments of past periods for calculation. In each case, the meeting of shareholders establishes a specific level of profit to be distributed. To determine the participant's income, it is necessary to multiply the number of shares that he owns by the dividends calculated earlier:

Income \u003d D * A, where A is the number of shares owned by the participant.

So it is possible calculate the amount of dividend on ordinary shares. However, in the financial world there is such a thing as reinvestment. The dividends received by the owners of securities can be directed to the purchase of new shares. This is reinvestment. This fact must be taken into account when making calculations. At the end of the operating period and its beginning, the number of shares of a participant may change due to reinvestment.

Such calculations allow you to determine the dividend yield. This is the return on the initial investment. For calculations, it is necessary to take data on the value of the company's shares on the stock market. This figure is constantly changing.

Yield Calculation Example

Using the above formulas, you should find the dividends that the company pays per share. Further, in the stock market, one should consider the quoted value of the organization's securities at the time of the study. Next is the calculation:

DD = D/KS, where DD - dividend yield, KS - share price.

This technique allows you to compare the amount that the participant received in the form of dividends and the real value of the share. The higher the indicator, the higher the yield of the securities. This is the income that the owner receives from the use of his investment in the business of the company.

To make it clear how to calculate dividends example The definition of profitability should be studied in the process of determining these indicators. Let's say a participant owns 50 common shares. Each of them costs 20 rubles. Dividends in the current period were paid for each security in the amount of 1 rub. The amount of dividends will be calculated as follows:

D \u003d 50 * 1 \u003d 50 rubles.

The yield will be as follows:

DD = 1/20 = 0.05 = 5%

This year, investments have brought a return of 5%. If a company has consistently paid dividends for several years, it may be beneficial for an investor to receive a small but steady income. In this case, he can invest his funds in the activities of the company. However, in some cases, the person who owns the capital wants to receive a large income. In this case, he should consider financing options for a more risky project. Then the acquisition of the shares presented above will not be the best option. You should look for an organization that offers a higher return on securities.

Tax Calculation

And a joint-stock company with the usual tax regime? In this case, the retention procedure should be taken into account mandatory payments in state funds and budget. The accounting service of the organization is responsible for the calculation, deduction and transfer of such funds.

The following formula is used to calculate the tax amount:

N = PD * NC * (OD - PD), where N is the amount of tax that will be withheld from the profit distributed among the participants, PD is the ratio between the amount of dividends per share to the total amount of profit to be distributed, NC - tax rate, OD - the total number of dividends paid by the company, PD - dividends received by the organization from participation in the authorized capital of other companies.

The PD indicator is taken into account in the event that in previous periods the corresponding amounts were not withheld when calculating taxes.

Many factors must be taken into account when determining the indicators presented. When determining the OD indicator, it is necessary to exclude the amount of dividends that were transferred in favor of foreign companies or individuals. When calculating it, you need to take into account payments from which income tax will not be withheld.

The tax rate is determined for dividends of past periods according to the level established on the date of calculation.

When calculating the PD indicator, “net” dividends should be taken into account. They were previously subject to income tax. Dividends from domestic and foreign companies are included in the calculations. In this case, it is possible that when calculating the formula, the result will be negative. This can be observed if the OD is less than the PD. This means that the amount of dividends that is distributed among the participants will be less than the profit received by the organization from participation in the authorized capital of other companies. In this case, the tax payment amount is not formed, and reimbursement from the budget is not performed.

Reduced rate

In some cases, a preferential rate of 0% is provided. It is used only in relation to income tax. A number of conditions must be met when applying the preferential rate.

You can use the 0% tax only if the recipient of dividend income owns on the day of payment 50% or more of the shares that form the authorized capital. At the same time, the continuous period of his holding of securities is 365 days.

Calculation of income under the simplified tax system

To understand how to calculate dividends under USN, you should consider the procedure on a specific example. Suppose an organization pays taxes in this mode at a rate of 6%. If you want to pay dividends to an individual, you should calculate the part of net profit due to him. Let's say this amount was 60 thousand rubles.

First, NDLF is determined. An individual is a resident of the Russian Federation, so the tax rate is 13%:

H \u003d 60 * 13% \u003d 7.8 thousand rubles.

a simple calculation is applied:

D \u003d 60 - 7.8 \u003d 52.2 thousand rubles.

The participant of the organization receives this amount on the established date of payment of dividends. At the same time, the organization transfers the amount of tax to the budget.

Considering the technology how to calculate dividends, each owner of securities will be able to determine the income due on their securities.

When calculating the amount of dividends, it is worth relying on the rules prescribed in the legislation Russian Federation, as well as on the standards established by the enterprise itself.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Let's figure out what to consider when making calculations in 2020. Each society systematically shares a part of the profits received from the conduct of activities.

Although the company may decide not to pay such funds, but to direct them to business development.

If, nevertheless, the amount and timing of the transfer of dividends are established, it is necessary to understand by what rules the calculations of the due funds are carried out.

After all, it is known that dividend payments can be different. So, it is worth paying attention to all the nuances of the calculations.

Required Information

Russian legislation establishes the procedure for paying dividends. There is also a definition of the concept itself. Let's take a closer look at the information provided in the regulatory documents.

Basic definitions

Dividends are part of the income of joint-stock companies or other objects leading economic activity, which is distributed among the participants (shareholders) in accordance with their shares in the authorized capital.

The size and rules for the transfer of dividends are determined at a meeting of shareholders, founders, and are also fixed in the charter of the enterprise.

Dividends may be paid in cash or issued in shares or other property.

What are the payment terms?

The amount of established dividends can be transferred several times a year. But it may not be paid at all.

With the payment of such funds, capitalization decreases and this requires savings that were not allowed for reinvestment or are withdrawn from it.

Those dividends that are paid during the financial year are interim or preliminary. At the end of the billing period, final dividend payments are made.

As a result of the activities of the organization, they form financial statements, the components of which are:

The reporting period for the preparation of such documents is a quarter, 6, 9 and 12 months.

In accordance with the law, the amount of dividends cannot be transferred more often than once a quarter after the financial statements are approved.

But it is worth considering that financial results for the year may differ from the interim quarterly result. And in such situations, overpayment of dividends is possible.

The LLC Law states that the payment of dividends must be made within 60 days from the date of the decision at the meeting.

Otherwise, the company has the right to independently decide when and how to pay the due part of the profit to the founders. But such rules must be written in the local documentation.

There are situations when internal documents say nothing about the payment of dividends. Then you should be guided by the general rules established by the regulatory documents of the Russian Federation.

Dividends are not allowed:

- if the entire required amount has not been contributed to the authorized capital;

- if the share is not paid to the participant;

- if the firm is on the verge of bankruptcy or on the payment date

- dividend will become insolvent;

- if the amount of net assets is less than the authorized and reserve capital.

- shares were not redeemed in accordance with Article 76 of the Federal Law of the Russian Federation "On OJSC".

Legal grounds

The rules for the distribution of income in the form of dividends between the founders of the enterprise are established by a regulatory document approved by the legislators of Russia.

The timing of dividend payments is set in accordance with.

How to calculate the level of dividends in the enterprise?

In addition, there are a number of features that you need to remember when preparing a depositary receipt. But knowledge in this area will also not be enough. Therefore, we will analyze how the calculations are carried out, what should be taken into account.

For ordinary shares

The calculation of dividends for ordinary shares depends on whether the dividend yield is determined. And this indicator is determined using the following formula:

You can also use another method for calculating dividends:

- It is worth starting to calculate dividends by checking whether the conditions of regulatory documentation are met.

- Determine if there are restrictions on enumerations.

- Calculate the value of the company's net assets, which is equal to the difference between the asset and liability that are accepted for calculation.

Calculation of the balance of net assets of the firm's income is carried out at the end of the financial year. They are subtracted from the net income of mandatory contributions to reserves and the amount of advance application of income in the reporting period.

Advance application is acceptable in the absence of past income, free depreciation balances or funds to finance investment programs.

The amount of dividends is determined by multiplying the balance of net income by the adjustment factor K1, K2.K1 establishes the board of directors. Usually it is 1. K2 can be 1, 0.85, 0.5.

When calculating dividends from ordinary shares, it is worth predicting the average dividend for recent periods and setting their size at the present time.

When analyzing the amount of income, it should be borne in mind that the transfer of funds to participants is not included in the development of the enterprise. Analyze the percentage of the company's net income that will be paid to shareholders.

Large dividends should be amortized by a large enterprise that is developed. Young companies pay dividends reluctantly.

Conservative investors need to buy stocks that pay higher dividends. Such stocks will grow slowly, which means that there will be higher dividend yields.

By privileged

Preference stocks lend themselves better to forecasting. Companies have to pay often 10% of the company's income. Such an indicator should be paid in without fail.

It is worth dividing 10% of the income into all preferred shares. So you can get the minimum amount enumerations. But firms rarely pay more than that.

If with one founder

All transfers of dividends are made by decision of the meeting of founders. But if there is only one founder, then he has the right to independently make such a decision and draw it up in writing (Article 39 normative document Russian Federation No. 14-FZ).

Those funds that will be received by such a person are subject to income tax individual at a rate of 9%, and from 2020 - 13%.

When accruing dividends, it is worth fulfilling a number of conditions prescribed in Art. 29 of act No. 14-FZ.

The right of the sole founder to make decisions on payment is referred to in paragraph 2 of Art. 7 of the legislative document of the Russian Federation No. 14-FZ.

There are no regulated documents that would formalize the decision on the transfer of dividends. However, such decisions must be made in writing.

So the protocol should indicate:

- the amount of payments;

- the form in which the dividends will be paid;

- receipt period.

This means that line 2400 should contain retained earnings, which will be revealed in the reporting period.

Net profit is reflected in line 2400 of the Statement of Financial Results, which may coincide with the indicators of retained income in line 1370 of the Balance Sheet.

But it is possible if:

- at the beginning of the reporting periods, the company will not have retained earnings of previous periods;

- no interim dividends were distributed during the reporting period;

- if in the reporting period the revalued objects of fixed assets were not retired.

Otherwise, the amount of interim dividends will reduce the income of the reporting period, and the values in the lines indicated above will not match.

Dividends are understood as a certain part of the profit of the organization, proportionally paid to the owners (shareholders) of the company. The amount of dividends, frequency, accrual and payment procedure will be determined by the shareholders themselves at a special meeting.

Dividends can be accrued at any frequency or not paid at all. The distribution of dividends to shareholders reduces the amount of capital that can be invested further in business development, so small companies often refuse this procedure.

Interest payments can be interim or final. Those deductions from profits that occur during the year are considered intermediate. Total are calculated according to financial results of the year. Dividends can be expressed in the form of real money or additional shares.

What determines the amount of income from shares

Dividends are not always paid in full, the amount of accrued profit may vary in the following cases:

The amount of dividends is fixed not by percentage, but by actual terms. Such measures are necessary to replenish the reserve and stabilization funds of the enterprise;

Large investments in production are required, it was decided to expand the scope of activities, scale the business. In this case, payments are frozen or reduced;

It is necessary to show the stability and prospects of the company. In this case, the amount of dividends increases;

The tax rate has risen.

How dividends are calculated

Dividends are calculated from the net profit of the company, that is, from that part of the income with which taxes are paid and the necessary calculations are made to stabilization and other funds. Payments on preferred shares are made in fixed amounts, the rest in percentage terms, according to the share of each owner.

To calculate the amount of dividends yourself, you need to know the organization's profit for the reporting period and the amount of tax calculations. A simple subtraction yields net income. The charter of the organization defines the percentage of net profit that goes to pay dividends. This percentage is multiplied by net profit, and the resulting value is the total profit of all shareholders. Further, proportionally, depending on the number of shares in hand, the personal income of each shareholder is calculated.

Refusal to pay dividends

In some cases, the company has the right to refuse to pay income on shares. The law defines the following cases when the payment of dividends may be suspended:

The funds on the account were not enough to pay the authorized capital;

The first signs of the company's bankruptcy were revealed;

The payment of dividends can lead to bankruptcy of the company;

Assets consist of a reserve fund and authorized capital.

Dividends are paid when financial difficulties give way to stability. Sometimes the suspension of payments may be indicated as a mandatory condition in the loan agreement.

When a company makes a net profit, it can either reinvest that profit into its own growth (for example, by purchasing new equipment; profit spent in this way is called "retained earnings") or pay dividends to its investors. Calculating the total amount of dividends owed to you personally is quite simple - to do this, multiply the dividends per share by the number of shares you own. In addition, a "dividend yield" or percentage of return on the initial investment can be defined; To do this, you need to divide the dividend per share by the value of one share.

Steps

Dividend Calculation

- The values of D, SD and S can be found in the company's financial statements.

- Please note that the dividend payout rate may change over time. Thus, if you use past dividend payouts to estimate future dividend payouts, you are likely to get wrong numbers.

-

Multiply dividends per share by the number of shares you own. This is how you will know the dividends you will receive. That is, use the formula D = DPS x S, where D is the dividend that you will receive; S is the number of shares you own. Remember that since you are using past dividends per share, your estimate of future dividend payments may differ slightly from actual values.

- For example, you own 1,000 shares and your dividend per share was $0.75 last year. Substitute these values into the formula and get: D = 0.75 x 1000 = $750. That is, if the dividend per share does not change this year, then you will receive $750 in dividends.

-

You can use the calculator if you are calculating dividends for large investors and work with large numbers. Dividend calculator can be found on the Internet, for example.

- There are also investment calculators, for example, this one, with which you can find dividends per share (if you know the total amount of dividends and the number of shares you own).

-

Don't forget to factor in the reinvestment of dividends. The above process is for relatively simple cases where the number of shares held by an investor is a fixed amount. However, in real life investors often use dividends to buy more shares; this is called reinvesting dividends. If you are in the business of reinvesting dividends, take this fact into account when calculating your dividend payout, as the number of your shares is constantly increasing.

- For example, let's say you receive $100 in dividends each year and spend it on buying more shares. If the price per share is $10 and the dividend per share is $1, then you buy 10 additional shares each year, which earns you $10 in additional dividends per year (that is, you will receive $110 in dividends next year). If the price per share remains the same, then next year you will buy 11 additional shares, and the next year you will buy 12 additional shares, and so on.

Calculating the dividend yield

-

Determine the price per share. Sometimes when investors want to calculate dividends, they are actually going to find the dividend yield. Dividend yield characterizes the profitability of your initial investment (that is, the income received from them). In other words, the dividend yield can be viewed as analogous to the interest rate. First you need to find the price per share.

-

Find the dividend per share (DPS). Dividends per share are calculated using the formula DPS = (D - SD)/S, where D is the amount paid in the form of regular dividends, SD is the amount paid in the form of special (one-time) dividends, S is the total number of shares.

- The values of D, SD and S can be found in the company's financial statements. Refer to the company's most recent financial statements for the most accurate figures.

-

Divide the dividend per share by the price per share to find the dividend yield (or in other words, use the formula DY = DPS/SP). This simple ratio compares the amount you received in dividends and the amount you invested in buying shares. The higher the dividend yield, the more money you make (for your initial investment).

- For example, you own 50 shares for which you paid $20 per share. If dividends per share have been $1 in recent periods, you can find the dividend yield by plugging those values into the formula DY = DPS/SP: DY = 1/20 = 0.05 = 5%. In other words, your investment will bring you 5% in dividends annually.

-

Use the dividend yield to analyze returns on various investments and make investment decisions. Investors often use dividend yields to determine whether certain investments should be made or not. Different dividend yields are attractive to different investors. For example, an investor who is looking for a steady, consistent source of income might invest in companies with high dividend yields (usually successful, well-known companies). On the other hand, an investor who is willing to take risks for large payouts in the future may invest in a young company with great growth potential (usually such companies keep most of their profits as retained earnings and do not pay dividends until they become successful companies). Thus, knowing the dividend yield, you can make one or another investment decision.

- For example, let's say that two competing companies offer $2 in dividends per share. At first glance, these are the same investment opportunities; but if the shares of one company are trading at $20 per share, and the shares of another company are trading at $100 per share, then it is better to invest in shares at $20 (ceteris paribus), since in this case the dividend yield is 2/20 = 10%, while the dividend yield for the second company (which has $100 shares) is 2/100 = 2% (of your initial investment).

- View the investment prospectus of the company or fund for more information on dividends.

Warnings

- Not all companies or funds pay dividends. Such companies or funds are of investment interest in terms of the growth of their shares, that is, you make a profit when selling such shares. On the other hand, in times of instability, companies prefer to reinvest dividends in themselves.

- The calculation of the dividend yield assumes a constant amount of dividends. However, this is not always the case.

Determine the number of shares you own. You can find this information by contacting a broker or investment agency, or by checking the company's mail or email alerts to its investors.

This is the amount of money a company pays out to investors per share. Dividends per share are calculated using the formula DPS = (D - SD)/S, where D is the amount paid in the form of regular dividends, SD is the amount paid in the form of special (one-time) dividends, S is the total number of shares.